The US has always been and remains the largest market and the best place for short-term rentals. With a 37% market share, it outperforms Europe and other regions, and it doesn’t seem to change soon despite strict Airbnb regulations in many US cities.

But what are the best places to buy short-term rental property in the US? We have analyzed the latest data and multiple reports to guide you. Learn top Airbnb destinations in the USA with revenue potential, occupancy, daily rates, and other crucial details below.

The US is one of the best vacation rental markets globally

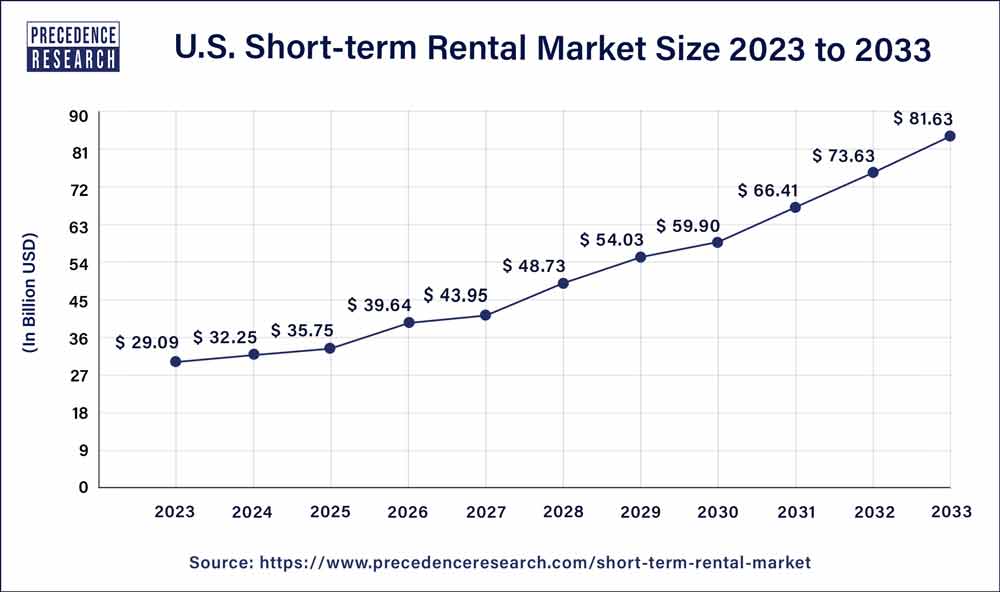

Short-term and vacation rentals flourish in places with lots of tourists, nice nature, and a long coastline. The US has it all. Its short-term rental market size is expected to reach US $81.63 billion by 2033 from US $35.75 billion in 2025, growing at an 11% CARG.

Other indicators also show positive market tendencies and why the US is one of the best STR markets. By the end of 2025, occupancy rates will reach 56%, returning to the pre-pandemic level. Small and mid-size cities witness the most significant growth, as short-term rentals are less regulated there compared to large cities like New York or San Francisco.

Source: AirDNA

Of course, there is no perfect place to start Airbnb rentals for everyone. The choice will depend on your readiness to manage a specific property, the sum you can invest, expected income, and many other factors. Not sure if your rental is short or mid-term? Take a look at a side-to-side comparison of STRs and LTRs.

Top 9 Airbnb locations in the US

Now, let’s put all the factors that make for the most profitable short-term rental markets together. We have evaluated multiple locations across the US to list those where an STR business can grow and generate good revenue. It’s not a ranking but rather a list of top choices to consider.

How have we selected the best cities for Airbnb?

We have used multiple resources to gather data, including AirDNA, Statista, Airbnb, and Inside Airbnb, to complete the listing. The locations named as up-and-coming Airbnb markets have the highest number of tourists, occupancy, daily rates, and revenue potential across the US. We have also included cities famous for attractions or beautiful nature close by.

| City |

Avg. Daily Rate |

Annual Rev. Potential | Occupancy Rate |

|

New Orleans, LA |

US $290 |

US $31,000 |

51% |

|

Las Vegas, NV |

US $305 |

US $26,300 | 51% |

|

Maui, HI |

US $635 |

US $66,600 |

65% |

|

New York, NY |

US $262 |

US $19,600 |

57% |

|

Sedona, AZ |

US $342 |

US $48,200 |

60% |

|

Orlando, FL |

US $240 |

US $23,100 |

55% |

| Columbus, GA | US $159 | US $18,500 |

55% |

|

Los Angeles, CA |

US $270 | US $18,600 | 55% |

| San Diego, CA | US $336 | US $40,200 |

59% |

1. New Orleans, LA

This city in Louisiana holds lots of popular events such as Mardi Gras, Jazz & Heritage Festival, and Essence Music Festival. Millions of people come every year looking for apartments and rooms to rent short-term. It also has historic neighborhoods like the French Quarter and Bywater, where tourists like to live, and the nightlife is vibrant. The property prices are relatively low compared to cities like NYC or San Francisco, whereas the average number of visitors exceeds 18 million annually.

- Average daily rate: US $290.2

- Annual revenue potential: US $31,000

- Occupancy rate: 51%

- High and low season: February to May is the high season; June to August is the low season.

Regulations: Zoning restrictions that specify the number of short-term rentals per square block; Short-term rental permit is required.

2. Las Vegas, NV

Las Vegas is a must-have in the list of the most popular Airbnb destinations in the USA. It’s the sixth US city most visited by international tourists, with over 2 million visitors. Americans also love going to Las Vegas for a weekend, which makes it a great option for short-term rental investments. This gambling, shopping, and entertainment center will keep becoming even more popular in the following years.

- Average daily rate: US $305

- Annual revenue potential: US $26.3k

- Occupancy rate: 51%

- High and low season: March to May and September to November is the high season; June to August is the low season.

- Regulations: Short-term rental license is required; Zoning laws; Other short-term rental limitations.

3. Maui, HI

Maui is a paradise everyone would like to live in, at least for a few days. This 17th largest US island is among the best places to invest in short-term rental if you want to offer a place for vacations. The cost of property is high, with many luxury properties available, but the strong tourism demand and revenue potential you get are worth it.

- Average daily rate: US $635

- Annual revenue potential: US $66,600

- Occupancy rate: 65%

- High and low season: December to April is the high season; April to June is the low season.

- Regulations: Short-term rental permit is required; Zoning laws in progress.

4. New York, NY

NYC falls under the top Airbnb markets for obvious reasons. It’s a legend. This US city gets the most international tourists, with almost 9 million visitors annually. The Statue of Liberty, Broadway, Rockefeller Center, and Central Park are just a few of dozens of tourist destinations. Rent out a property somewhere nearby, and great occupancy is guaranteed. The short-term regulations in NYC are pretty strict, but you can adapt to them with the right approach.

- Average daily rate: US $262

- Annual revenue potential: US $19,600

- Occupancy rate: 57%

- High and low season: Late May to early September and November to December is the high season; January to March is the low season.

- Regulations: Short-Term Rental Registration Law that requires hosts to register a property and use it as a primary residence.

5. Sedona, AZ

Sedona is a magnet for hiking and biking lovers. Its iconic red rock formations with multiple trails attract tourists who love outdoor activities for the weekend. It also has rich arts and culture life for those who prefer slow walks through galleries. High occupancy rates make it a well-deserved option among the best ROI Airbnb cities.

- Average daily rate: US $342

- Annual revenue potential: US $48,200

- Occupancy rate: 60%

- High and low season: March to May and September to November is the high season; December to February is the low season.

- Regulations: STR-friendly city; Local STR license is required.

6. Orlando, FL

Orlando is home to Walt Disney World Resort and Universal Studios, each attracting millions of tourists annually. It also has a warm climate, and the Orlando International Airport, 6 miles from downtown, makes it an attractive and easily accessible destination.

- Average daily rate: US $240

- Annual revenue potential: US $23,100

- Occupancy rate: 55%

- High and low season: The high season most of the year, with lower periods in January – February and during the hurricane season.

- Regulations: STR-friendly city; Official registration is required.

7. Columbus, GA

We included Columbus in the most profitable short-term rental markets because it has affordable property and low saturation. You may want to invest in purchasing property now before the prices start soaring. The city hosts a large US Army base, with many families coming for a visit, and numerous museums.

- Average daily rate: US $159

- Annual revenue potential: US $18,500

- Occupancy rate: 55%

- High and low season: April to May and September to October is the high season; Winter months are the low season.

- Regulations: STR permit for each rental unit; Limited occupancy; Local contact person must be available 24/7.

8. Los Angeles, CA

Los Angeles takes third place in the chart of the cities most visited by international tourists, with 3.6 million visitors. It has year-round tourist demand, and property prices keep steadily growing. Coachella, Academy Awards, Fashion Week, and tons of celebrities walking on the streets attract fans from all over the globe. These people need to live somewhere and make LA one of the best short-term rental markets.

- Average daily rate: US $270

- Annual revenue potential: US $18,600

- Occupancy rate: 55%

- High and low season: The high season lasts the majority of the year, with a low period from December to February.

- Regulations: Registration with the city planning department; 120-day limit for short-term rentals; Primary residence requirement.

9. San Diego, CA

San Diego has nice beaches and warm weather, which attracts tourists and a growing economy, making it a busy business center. That’s why buying a property in San Diego is a profitable investment both for short- and long-term rentals. Middletown, Mission Hills, North Park, and Mission Value are the top areas to consider for an STR business.

- Average daily rate: US $336

- Annual revenue potential: US $40,200

- Occupancy rate: 59%

- High and low season: March to May and September to November is the high season; November to February is the low season.

- Regulations: Registration required with four license types. Learn more about San Diego short-term rental law.

What makes the best places for short-term rentals?

You should consider many things when evaluating the best markets for short-term rentals in the US. Is this place popular with tourists? Does it have more visitors in summer than in winter? Are there any regulations limiting short-term rentals through Airbnb and similar platforms? Answers to these and other questions are critical to make the right choice. So, let’s talk about the main factors that make a place a good or bad choice for investment.

Destination popularity

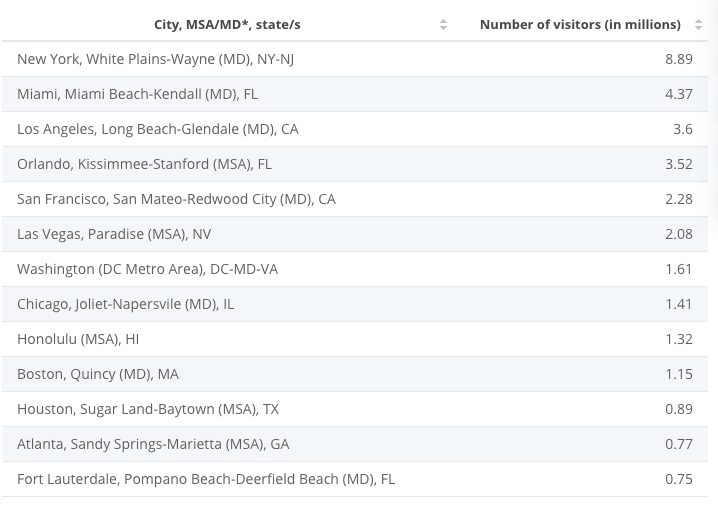

The number of tourists directly affects occupancy and the ease of renting your apartment. The closer you are to famous tourist attractions and cultural landmarks, the more you can charge. Proximity to the city center also matters. People are ready to pay a few bucks more to have a nice walk instead of taking public transport from city slums. That’s why if you consider the best place to invest in vacation rental property, you should check its popularity with tourists and prefer central locations.

Source: Statista

Source: Statista

Seasonality

Winter and early spring are lower seasons for many destinations, but the US is huge and diverse. For example, Las Vegas is known for its desert heat, which repels visitors from coming in summer. Miami is also more popular in winter when people seek sun and warmth than in summer when hurricane season starts. Some cities like New York are less dependent on seasonality but have low and high seasons anyway. When choosing the best place to buy a short-term rental property, your goal is to pick a location where the off-peak season is short.

Occupancy rates

Few properties are busy 100% of the time, if any. The average Airbnb and Vbro occupancy rate in the US is 54%. This means that only 54% of rooms are occupied during the rental period. A good occupancy rate is considered 70%, but few of the best locations for short-term rentals can ensure it. Therefore, you should at least compare the occupancy in your potential destination to the market average and prefer the location with higher rates.

Revenue potential

You should calculate potential ROI while considering the best places to buy a short-term rental. ROI is the difference between the total rental income and total operating costs. If you pay a mortgage or Airbnb arbitrage, you must also include it in calculations.

The higher the ROI, the more you earn from renting out your property. Overall, 8% to 12% ROI is considered a good result for short-term rentals. Find detailed instructions on calculating ROI in our article.

Accessibility and transportation

A house in the woods may seem romantic, but it can be too difficult to reach. Unless you focus on guests who value solitude and want to escape city life, accessibility is another thing that matters. Tourists often arrive without their personal transport and want to stay close to a metro or bus station, saving time and money.

Regulatory landscape

With the recent wave of STR bans and limitations, regulations can ruin even the hottest Airbnb markets. In New York, you must register your rental with the city and rent only the place that is your primary residence. Los Angeles similarly requires registration and limits short-term rentals to no more than 120 days annually. Denver, Las Vegas, San Diego, and other cities also regulate short-term rentals. STR business is no longer unlimited, and you must understand what it will take to rent your property by the law.