Arbitrage allows you to do rental business without owning a property. You can rent an apartment long-term, sublet it on Airbnb, and earn the margin. It may become an additional source of income or a separate business you to make a living.

But it’s not that easy.

The profitability of the rental arbitrage model depends on many factors, including property location, effective guest damage prevention, and thought-out pricing. More about how to start rental arbitrage successfully in our post. You will also learn what is short-term rental arbitrage, its legitimacy, its pros and cons, and tips to maximize earnings.

What is Airbnb arbitrage?

Airbnb arbitrage is when someone leases a property long-term and then provides it for short-term rentals through platforms like Vrbo or Airbnb. Such hosts usually slightly change the look of the property and buy additional amenities to make it more suitable for short-term rentals. Airbnb guests need slightly different things than long-term tenants. They seek extra comfort, soft towels, and a fully equipped kitchen.

When you sign an Airbnb rental arbitrage contract with the landlord, you become a middleman between the property and guests. Such an agreement includes the sublease terms and confirms that the owner knows what happens with their property. You can rent the entire apartment (if it’s allowed by the local law) or several rooms. This model has become particularly popular with the soaring rental prices and the growth of the sharing economy.

Thinking about investing in real estate? Here are the best places to buy a second home in Europe, just in case.

How does Airbnb arbitrage work in real life?

Short-term rental arbitrage can have several models. The most popular is when you rent a property long-term and re-rent it fully or partially for short-term stays, making money on the spread. Another option is leasing properties in busy business locations and subleasing them to corporate clients. Or you can sign a lease-to-own agreement with the landlord and rent out the property through Airbnb while you still pay off the lease.

So what is rental arbitrage and how does it work? Here is an example to better understand.

Suppose you want to rent through Airbnb and have found a property that allows short-term rentals:

- You rent an apartment for $1200/per month.

- You replace some furniture to make it more stylish and buy other amenities required for successful short-term rentals. Find more details on how to start a short-term rental business in our blog.

- You charge $120 per night based on the local prices. If the property is booked 20 nights/ month, you earn $2400.

- You pay the monthly rent and have $1200 left. It’s your gross monthly income from Airbnb rental arbitrage.

It’s a rough description of a business model for real-estate arbitrage Airbnb. You will also need to calculate the NET income and mind all expenses related to renting the property. Learn more about the profitability of short- vs. long-term rentals.

Is Airbnb rental arbitrage legal?

The worries about the legitimacy of rental arbitrage are what stop many people from starting such a business. Let’s make it clear from the start. Is Airbnb arbitrage legal? Yes, if you follow the rules.

Many cities have local STR regulations that limit the use of property for short-term rentals. Property owners may also be against using their places for Airbnb due to increased risks of wear and tear. Overall, Airbnb doesn’t prohibit rental arbitrage, but you must act within the law.

Study local regulations before subletting your property and get written consent from your landlord. If the law allows it and the property owner doesn’t mind, Airbnb rental arbitrage is legal.

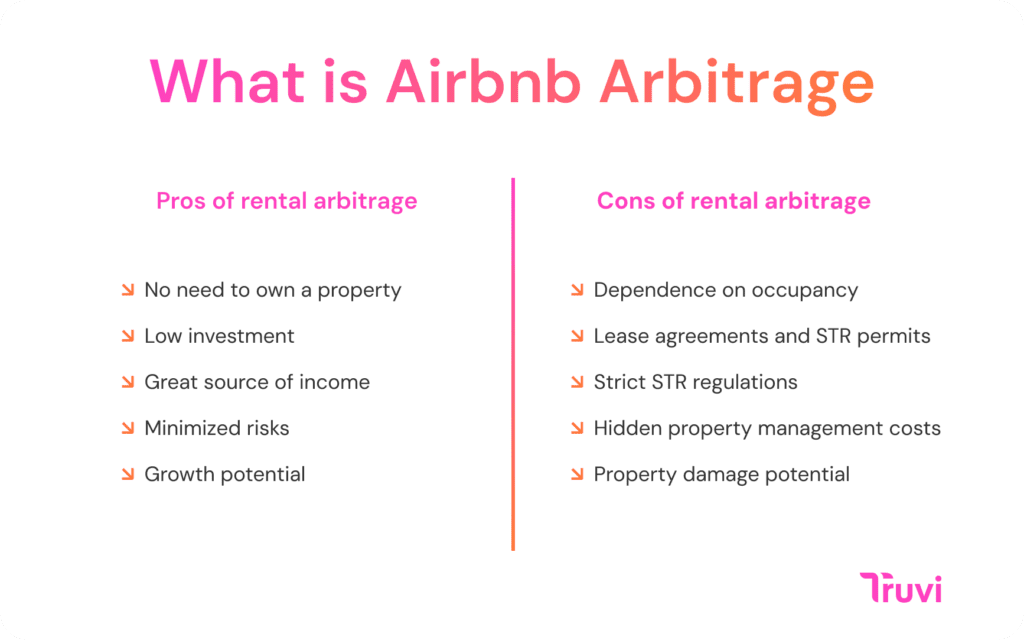

Pros and cons of Airbnb rental arbitrage

Before starting an Airbnb rental arbitrage route, you should know what challenges come with this business model. It will save you from disappointment and better equip you to turn the Airbnb rental arbitrage profitable. Here are the main benefits and drawbacks of subletting.

Pros of rental arbitrage

- No need to own a property. You don’t need to buy an apartment to rent it and can easily switch to another place if rentals don’t perform as expected.

- Low investment. Arbitrage requires a much lower upfront investment than buying a property. You may only need to spend on decorating your property, amenities, and an STR license.

- Great source of income. Is Airbnb arbitrage profitable? Yes, and it’s the main benefit of this model. If you set up everything right, you will have a steady flow of income.

- Minimized risks. There are no risks of investing in the wrong property or suffering from new local STR laws with little possibility of changing something. You also don’t have to worry about property depreciation and market fluctuations.

- Growth potential. If the local law allows it, you can easily scale and use vacation rental arbitrage to rent more properties.

Cons of rental arbitrage

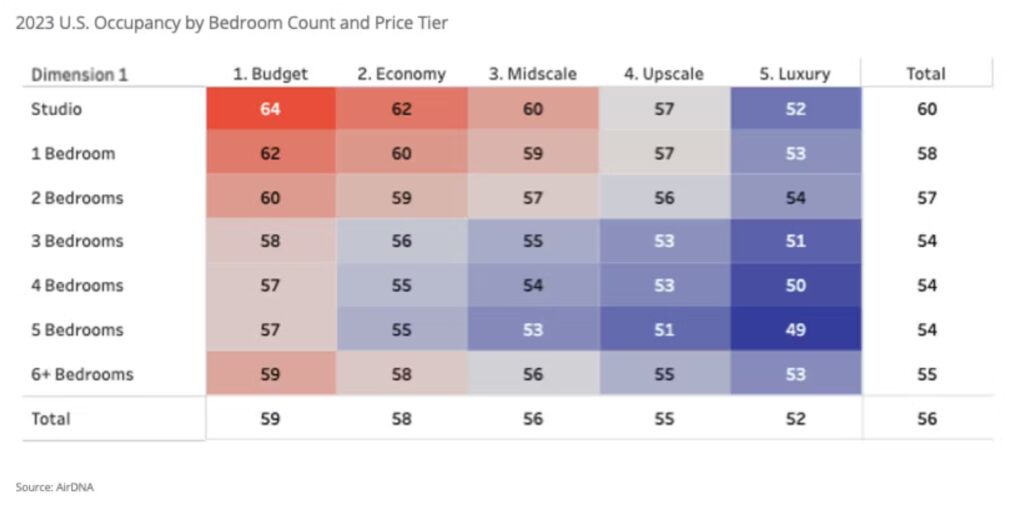

- Dependence on occupancy. Some places have strong seasonality, which affects occupancy rates. If your place has guests for 10 days/month only, losses can exceed the income.

- Lease agreements and STR permits. Finding a landlord ready to sign an Airbnb arbitrage lease agreement may be challenging. You may also need to obtain a short-term rental permit from a local authority and renew it annually.

- Strict STR regulations. Short-term rental regulations in many US cities like New York and popular tourist destinations in Europe are strict. They may limit the type of property allowed for short-term rentals and implement zoning restrictions.

- Hidden property management costs. Considering how to do Airbnb arbitrage, you must never forget about cleaning fees, maintenance, increased utility bills, furnishing costs, taxes, and other expenses.

- Property damage potential. Short-term rentals usually cause more damage as guests may not care about keeping the place intact. Wear and tear is also a big issue, and you must be ready to regularly replace furniture items and amenities. Read the Airbnb damage policy.

The most significant drawback of arbitrage property is that it requires active management. Rebecca Belnap, vacation rental host, shares what it takes to set up an Airbnb and keep it running smoothly:

“You have to stay on top of the legal changes, find landlords willing to sign a sublease addendum, and get the proper insurance. Next you are paying deposit, rent, utilities, furniture costs, dishes, pans, linens and all the things to make the house a home. Now add noise monitoring devices, keyless entry, backup systems and professional photography. Finally, you are up and running. Now you have vacancies, breakage, stains, pest control, and midnight calls needing instructions on how the keyless entry works.”

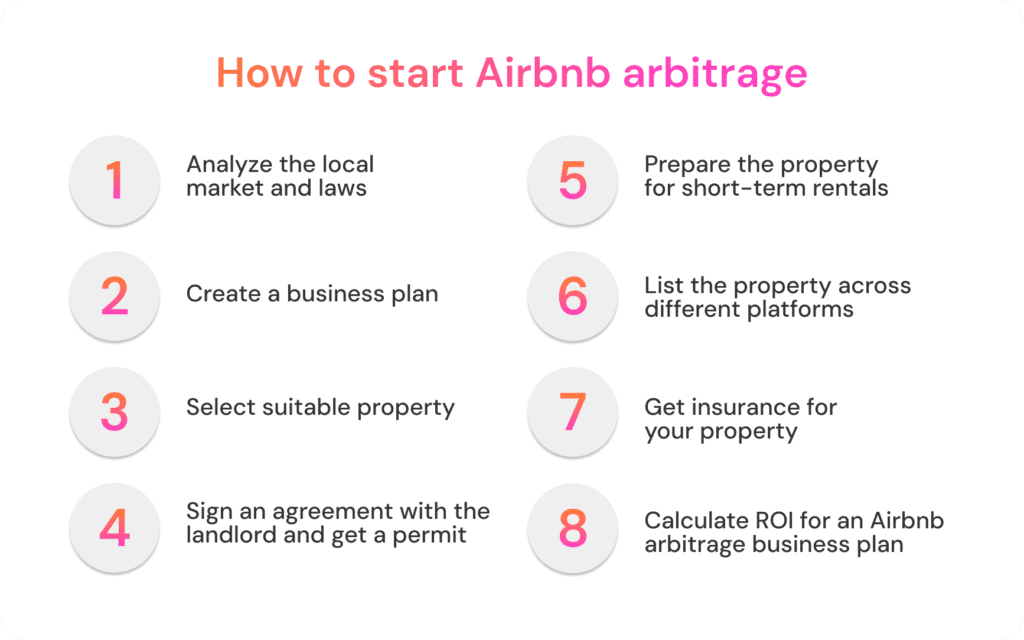

How to start Airbnb arbitrage

Starting a business with Airbnb arbitrage properties requires initial planning, market research, property setup, and promoting your rental. Below are the main steps you will need to take:

Analyze the local market and laws

Select several locations you consider for short-term rentals. Evaluate the local regulations, average rental prices, demand, and competition to start short-term rentals in a place that offers the perfect balance. We have recently covered the best Airbnb markets in the US in our blog.

Create a business plan

Calculate the potential income and expenses related to managing short-term rentals to design a business plan. Don’t go in blind. You must know the monthly rent for the primary lease and an approximate occupancy, daily rates, property management costs, and taxes to understand the margin and make sure rentals will be profitable.

Select suitable property

Check multiple properties within your price range and the preferred city area to pick the best one. Make sure the landlord gives you permission to sublet. Then, you should estimate whether the place is a good option for Airbnb rentals. We recommend leasing a one- or two-bedroom apartment and avoiding making it too luxurious. Most guests view Airbnb as an affordable and cozy alternative to hotels.

Sign an agreement with the landlord and get a permit

Obtain written consent from the landlord before transforming the rented property into a dream place for Airbnb guests. It will minimize the risk that the owner changes their mind at the last moment, and you will lose money invested in redesigning. If your local authorities require a permit for operating short-term rentals, you must get one. Such permits usually cost several hundred dollars and need annual renewal.

Prepare the property for short-term rentals

View Airbnb listings in the area and use Pinterest for redesign inspiration. Guests prefer listings with unique designs, a fully furnished kitchen, and amenities. You should also take nice pictures of the rented property that feature the number of beds, kitchen, bathroom, and things that can catch an eye in your listing, like a blooming garden or an outdoor pool.

List the property across different platforms

Create a concise property description. Checking other listings to understand what information is essential is the simplest way to write a good one for yourself. Don’t forget to include the registration number if your local regulations demand it. Airbnb, Vrbo, Booking.com, and Agoda are the most popular STR platforms on which to place a listing.

Get insurance for your property

How do you do Airbnb arbitrage without losing money? Insure your property for short-term rentals. You need a separate kind of insurance adapted for short-term rentals, and the coverage must be sufficient. In particular, local laws in Las Vegas require hosts to have a minimum of $500,000 in insurance coverage.

Once you are done with all the preparations, you must also take care of property maintenance. You can do it yourself, but it takes lots of time and may be draining. It may be better to hire a cleaning service with reasonable fees. You must also be ready to stay in touch with guests 24/7 and promptly respond to their requests.

Calculate ROI for an Airbnb arbitrage business plan

The return on investment is one of the key metrics in a rental arbitrage business plan. It lets you predict how much money you can make from Airbnb rental arbitrage and decide whether it’s worth the hassle. A good ROI for an STR business is 8 to 12%. If you fall within this range or exceed it, rental arbitrage is a good idea.

The ROI formula is the following: ROI = Total Investment / Net Income×100

Total investment = everything you spend to redesign property and keep it ready for ongoing rentals (e.g., monthly rent, design costs, cleaning fees, taxes, licensing costs, fixing property damage, insurance, etc.)

Net Income = everything you earn (Total income – Total expenses)

We have a detailed guide on how to make short-term rentals profitable with more tips and examples.

Tips on how to maximize your earnings from Airbnb arbitrage

Hosts who have a decent income from Airbnb rental arbitrage follow some common best practices. We have gathered the main ones below to help you make your STR business more cost-effective.

Implement the guest screening process

A reliable guest screening process can protect you from fraud, a worsening problem across booking platforms. You can automate this process with modern tools like Truvi. The platform runs guest screening, guest verification, and sex offender checks, detecting suspicious applicants so you can decline their booking early on. Such checks ensure only trustworthy people enter your place and minimize the risks of financial losses from fraud.

Consider outsourcing property management

If you have never dealt with short-term rentals and lack experience managing guest communications, cleaning, and other routines, consider hiring someone. There are dedicated vendors that offer property management services. Mind these expenses in your budget and recalculate the STR profitability before deciding whether hiring someone is feasible.

Get reliable STR insurance

Property damage is a common issue with short-term rentals. Strangers come to your property and leave for good even after they break something. Especially after. You will soon go bankrupt if you pay for everything out of your pocket. That’s why you need insurance. You can also collect a damage deposit or sell a damage waiver with Truvi to hold the guests accountable for their actions.