Want to get into real estate but don’t have hundreds of thousands for a down payment? Airbnb arbitrage might be your answer. You rent an apartment long-term, sublet it on Airbnb, and keep the difference. It can become an additional income source or even a full-time business.

But it requires careful planning.

The success of rental arbitrage depends on several factors: choosing the right location, convincing landlords to work with you, managing guests effectively, and protecting yourself from risks. This guide covers everything you need to know about starting rental arbitrage safely — from understanding what markets work best to alternatives if arbitrage isn’t right for you, plus how to maximize earnings while minimizing problems.

Key takeaways:

- Airbnb arbitrage involves renting properties long-term and subletting them short-term for profit

- Legal in most areas, but requires landlord permission and compliance with local STR regulations

- Landlords may agree because arbitrage operators offer stable income, professional management, and often above-market rent

- Best markets combine consistent tourism demand with reasonable long-term rental costs

- Profitability has declined since the pandemic peaks, but remains viable with professional operations

- Alternatives include co-hosting, property management services, and revenue-sharing partnerships

- Success requires active management, guest screening, damage protection, and thorough market research

- Startup costs include furniture, deposits, permits, and ongoing operational expenses

What is Airbnb arbitrage?

Airbnb arbitrage is when someone leases a property long-term and then provides it for short-term rentals through platforms like Vrbo or Airbnb. Such hosts usually slightly change the look of the property and buy additional amenities to make it more suitable for short-term rentals. Airbnb guests need slightly different things than long-term tenants. They seek extra comfort, soft towels, and a fully equipped kitchen.

When you sign an Airbnb rental arbitrage contract with the landlord, you become a middleman between the property and guests. Such an agreement includes the sublease terms and confirms that the owner knows what happens with their property. You can rent the entire apartment (if it’s allowed by the local law) or several rooms. This model has become particularly popular with the soaring rental prices and the growth of the sharing economy.

Thinking about investing in real estate? Here are the best places to buy a second home in Europe, just in case.

How does Airbnb arbitrage work in real life?

Short-term rental arbitrage can have several models. The most popular is when you rent a property long-term and re-rent it fully or partially for short-term stays, making money on the spread. Another option is leasing properties in busy business locations and subleasing them to corporate clients. Or you can sign a lease-to-own agreement with the landlord and rent out the property through Airbnb while you still pay off the lease.

So what is rental arbitrage, and how does it work? Here’s an example to better understand.

Suppose you want to rent through Airbnb and have found a property that allows short-term rentals:

- You rent an apartment for $1200/per month.

- You replace some furniture to make it more stylish and buy other amenities required for successful short-term rentals. Find more details on how to start a short-term rental business in our blog.

- You charge $120 per night based on the local prices. If the property is booked 20 nights/ month, you earn $2400.

- You pay the monthly rent and have $1200 left. It’s your gross monthly income from Airbnb rental arbitrage.

It’s a rough description of a business model for real-estate arbitrage Airbnb. You will also need to calculate the NET income and mind all expenses related to renting the property. Learn more about the profitability of short- vs. long-term rentals.

Is Airbnb rental arbitrage legal?

Concerns about the legitimacy of rental arbitrage are what stop many people from starting such a business. Here’s the answer up front. Is Airbnb arbitrage legal? Yes, if you follow the rules.

Many cities have local STR regulations that limit the use of property for short-term rentals. Property owners may also be against using their places for Airbnb due to increased risks of wear and tear. Overall, Airbnb doesn’t prohibit rental arbitrage, but you must act within the law.

Study local regulations before subletting your property and get written consent from your landlord. If the law allows it and the property owner doesn’t mind, Airbnb rental arbitrage is legal.

Now that you understand the legal framework, the next question is whether arbitrage is still worth pursuing in today’s market.

Is Airbnb arbitrage still profitable in 2025?

The arbitrage landscape has changed significantly since the pandemic era, with both new opportunities and increased challenges.

Market maturation: The data shows how property selection affects success. According to 2023 occupancy rates, smaller properties consistently outperform larger ones, and budget-tier properties achieve higher occupancy than luxury ones:

2023 U.S. Occupancy Rates by Bedroom Count and Price Tier

| Property Size | Budget | Economy | Midscale | Upscale | Luxury | Average |

|---|---|---|---|---|---|---|

| Studio | 64% | 62% | 60% | 57% | 52% | 60% |

| 1 Bedroom | 62% | 60% | 59% | 57% | 53% | 58% |

| 2 Bedrooms | 60% | 59% | 57% | 56% | 54% | 57% |

| 3 Bedrooms | 58% | 56% | 55% | 53% | 51% | 54% |

| 4 Bedrooms | 57% | 55% | 54% | 53% | 50% | 54% |

| 5 Bedrooms | 57% | 55% | 53% | 51% | 49% | 54% |

| 6+ Bedrooms | 59% | 58% | 56% | 55% | 53% | 55% |

| Overall Average | 59% | 58% | 56% | 55% | 52% | 56% |

Source: AirDNA

Key insights for arbitrage operators:

- Studios and 1-bedroom properties achieve the highest occupancy (60% and 58%)

- Budget properties average 59% occupancy vs. 52% for luxury properties

- Larger properties (4+ bedrooms) struggle more with consistent bookings

This means your property selection strategy should prioritize smaller, budget-friendly units over luxury or large properties — exactly the opposite of what many new operators assume. Focus on affordable, cozy spaces rather than trying to compete with high-end accommodations.

Regulatory environment: Many major cities have implemented stricter short-term rental regulations, making arbitrage more challenging or impossible in some markets. Research local laws before committing to any location.

Increased competition: More operators have entered popular arbitrage markets, potentially affecting occupancy and rates in saturated areas.

Operational requirements: Success now requires more professional operations, including guest screening, damage protection, and active revenue management. The casual approach that may have worked in earlier years is less viable.

Current viability: Arbitrage can still be profitable with proper market selection, professional operations, and strong risk management systems. However, it requires more research, capital, and active management than in previous years.

If market conditions seem viable for your situation, the next step is to choose the right location. Not all cities offer equal arbitrage opportunities.

Best cities for Airbnb arbitrage in 2025

Success in arbitrage requires finding markets where short-term rental income can reliably exceed long-term rental costs plus operational expenses. Based on tourism patterns and rental market data, here are some promising locations for arbitrage:

High-demand, lower-cost markets

New Orleans, Louisiana

- Average daily rate: $172

- Occupancy rate: 58%

- Why it works for arbitrage: Major events like Mardi Gras, Jazz & Heritage Festival, and Essence Music Festival create consistent demand. Historic neighborhoods like the French Quarter attract tourists, while long-term rental costs remain reasonable.

Pittsburgh, Pennsylvania

- Average daily rate: $174

- Occupancy rate: 53%

- Why it works for arbitrage: Growing as a tourist hub with world-class museums, colorful neighborhoods, and direct travel connections to multiple states and Canada. Lower housing costs create better arbitrage margins.

Consistent demand markets

Orlando, Florida

- Average daily rate: $177

- Occupancy rate: 63%

- Why it works for arbitrage: Walt Disney World Resort and Universal Studios create year-round demand. High occupancy rates help justify monthly rent costs, and the warm climate attracts visitors consistently.

Burlington, Vermont

- Average daily rate: $179

- Occupancy rate: 72%

- Why it works for arbitrage: Excellent occupancy rates due to year-round appeal — water sports in summer and skiing in winter. High occupancy can offset higher seasonal rental costs.

High-volume tourism markets

Las Vegas, Nevada

- Average daily rate: $131

- Occupancy rate: 61%

- Why it works for arbitrage: Consistent demand from both international tourists and Americans taking weekend trips. While daily rates are lower, steady volume can support monthly rent obligations.

Research tools and market analysis

Use platforms like AirDNA, AllTheRooms, and other STR data tools to analyze potential markets. For a detailed analysis of the best Airbnb markets in the US, including additional cities and performance data, check our comprehensive market guide.

Key metrics to evaluate include:

- Average daily rates versus local monthly rent costs

- Occupancy percentages throughout the year

- Seasonality patterns and demand drivers

- Competition levels and market saturation

Factors that support arbitrage success

- Consistent tourism or business travel demand

- Reasonable long-term rental costs relative to STR earning potential

- Favorable local regulations for short-term rentals

- Strong transportation links and accessibility

- Multiple demand generators rather than single-season attractions

Before committing to any market, research local regulations, analyze competition levels, and calculate realistic occupancy and rate projections based on actual market data.

Once you’ve identified promising markets, you’ll face the biggest challenge: convincing property owners to let you sublet their properties.

Why would a landlord agree to arbitrage?

Finding landlords willing to allow short-term rental arbitrage can be challenging, but there are legitimate reasons why some property owners find these arrangements beneficial.

Stable rental income: Arbitrage operators typically pay rent monthly regardless of occupancy, providing landlords with predictable income compared to dealing with tenant turnover or vacancy periods.

Property maintenance incentives: Arbitrage operators depend on positive guest reviews, which creates strong incentives to maintain properties in excellent condition. Poor property conditions lead to bad reviews and lost bookings.

Professional management approach: Experienced arbitrage operators often treat properties more professionally than typical tenants, with regular cleaning schedules, maintenance checks, and systematic property care.

Higher rental rates: Some arbitrage operators can afford to pay above-market rent because short-term rentals can generate higher revenue than traditional long-term leases.

Reduced tenant-related issues: Professional arbitrage operators handle guest relations, maintenance coordination, and property issues themselves, reducing the landlord’s day-to-day management responsibilities.

How to approach landlords about arbitrage

Convincing a landlord to allow arbitrage requires addressing their concerns while demonstrating the benefits of working with a professional operator. Most landlords’ initial reaction will be skeptical, so your approach needs to be professional, transparent, and focused on their interests.

Create a professional presentation: Develop a clear business plan that shows your experience, projected income, and property management approach. Include references and demonstrate your commitment to professional operations.

Address common concerns: Landlords often worry about noise complaints, property damage, and increased wear. Explain your guest screening process, damage protection measures, and how you’ll handle any issues that arise.

Offer additional security measures: Consider providing larger security deposits, allowing periodic property inspections, or offering regular property condition reports to demonstrate transparency.

Start with properties that benefit most: Look for landlords dealing with vacancy issues, below-market rents, or properties that need active management. These situations may make arbitrage arrangements more attractive.

Demonstrate risk management: Explain how you screen guests, verify identities, and protect against property damage. Professional risk management systems can address many landlord concerns about unknown occupants.

Understanding both the benefits and challenges will help you make an informed decision about whether arbitrage fits your goals.

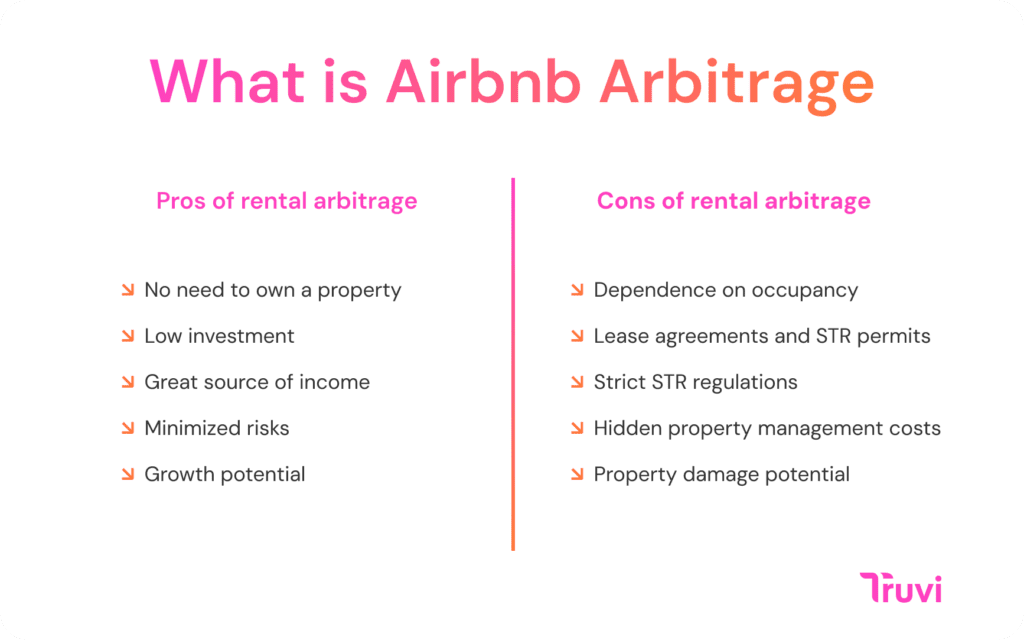

Pros and cons of Airbnb rental arbitrage

Before starting an Airbnb rental arbitrage business, you should know what challenges come with this model. It’ll save you from disappointment and better equip you to turn the Airbnb rental arbitrage profitable. Here are the main benefits and drawbacks of subletting.

Pros of rental arbitrage

- No need to own a property: You don’t need to buy an apartment to rent it, and can easily switch to another place if rentals don’t perform as expected.

- Low investment: Arbitrage requires a much lower upfront investment than buying a property. You may only need to spend on decorating your property, amenities, and an STR license.

- Great source of income: Is Airbnb arbitrage profitable? Yes, and it’s the main benefit of this model. If you set up everything right, you will have a steady flow of income.

- Minimized risks: There are no risks of investing in the wrong property or suffering from new local STR laws with little possibility of changing something. You also don’t have to worry about property depreciation and market fluctuations.

- Growth potential: If the local law allows it, you can easily scale and use vacation rental arbitrage to rent more properties.

Cons of rental arbitrage

- Dependence on occupancy: Some locations have strong seasonality that affects occupancy rates. If your place has guests for 10 days/month only, losses can exceed the income.

- Lease agreements and STR permits: Finding a landlord ready to sign an Airbnb arbitrage lease agreement may be challenging. You may also need to obtain a short-term rental permit from a local authority and renew it annually.

- Strict STR regulations: Short-term rental regulations in many US cities, like New York, and popular tourist destinations in Europe are strict. They may limit the type of property allowed for short-term rentals and implement zoning restrictions.

- Hidden property management costs: Considering how to do Airbnb arbitrage, you must never forget about cleaning fees, maintenance, increased utility bills, furnishing costs, taxes, and other expenses.

- Property damage potential: Short-term rentals usually cause more damage, as guests may not care about keeping the place intact. Wear and tear is also a big issue, and you must be ready to regularly replace furniture items and amenities. Read the Airbnb damage policy.

The most significant drawback of arbitrage property is that it requires active management. Rebecca Belnap, vacation rental host, shares what it takes to set up an Airbnb and keep it running smoothly:

“You have to stay on top of the legal changes, find landlords willing to sign a sublease addendum, and get the proper insurance. Next you are paying deposit, rent, utilities, furniture costs, dishes, pans, linens, and all the things to make the house a home.

Now add noise monitoring devices, keyless entry, backup systems, and professional photography. Finally, you are up and running. Now you have vacancies, breakage, stains, pest control, and midnight calls needing instructions on how the keyless entry works.”

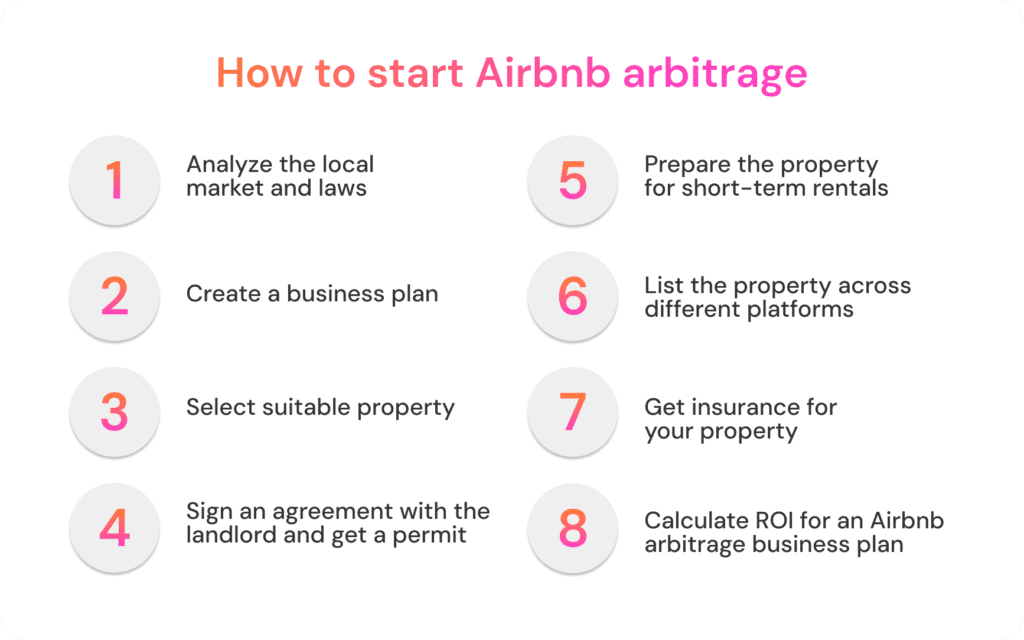

How to start Airbnb arbitrage

Starting a business with Airbnb arbitrage properties requires initial planning, market research, property setup, and promoting your rental. Below are the main steps you will need to take:

1. Analyze the local market and laws

Select several locations you consider for short-term rentals. Evaluate the local regulations, average rental prices, demand, and competition to start short-term rentals in a place that offers the perfect balance. We recently covered the best Airbnb markets in the US in our blog.

2. Create a business plan

Calculate the potential income and expenses related to managing short-term rentals to design a business plan. Don’t go in blind. You must know the monthly rent for the primary lease and an approximate occupancy, daily rates, property management costs, and taxes to understand the margin and make sure rentals will be profitable.

3. Select suitable properties

Check multiple properties within your price range and the preferred city area to pick the best one. Make sure the landlord gives you permission to sublet. Then, you should estimate whether the place is a good option for Airbnb rentals. We recommend leasing a one- or two-bedroom apartment and avoiding making it too luxurious. Most guests view Airbnb as an affordable and cozy alternative to hotels.

4. Sign an agreement with the landlord and get a permit

Obtain written consent from the landlord before transforming the rented property into a dream place for Airbnb guests. It will minimize the risk that the owner changes their mind at the last moment, and you will lose money invested in redesigning. If your local authorities require a permit for operating short-term rentals, you must get one. Such permits usually cost several hundred dollars and need annual renewal.

5. Prepare the property for short-term rentals

View Airbnb listings in the area and use Pinterest for redesign inspiration. Guests prefer listings with unique designs, a fully furnished kitchen, and amenities. You should also take nice pictures of the rented property that feature the number of beds, kitchen, bathroom, and things that can catch the eye in your listing, like a blooming garden or an outdoor pool.

6. List the property across different platforms

Create a concise property description. Checking other listings to understand what information is essential is the simplest way to write a good one for yourself. Don’t forget to include the registration number if your local regulations demand it. Airbnb, Vrbo, Booking.com, and Agoda are the most popular STR platforms on which to place a listing.

7. Get insurance for your property

How do you do Airbnb arbitrage without losing money? Insure your property for short-term rentals. You need a separate kind of insurance adapted for short-term rentals, and the coverage must be sufficient. In particular, local laws in Las Vegas require hosts to have a minimum of $500,000 in insurance coverage.

Once you are done with all the preparations, you must also take care of property maintenance. You can do it yourself, but it takes lots of time and may be draining. It may be better to hire a cleaning service with reasonable fees. You must also be ready to stay in touch with guests 24/7 and promptly respond to their requests.

8. Calculate ROI for an Airbnb arbitrage business plan

The return on investment is one of the key metrics in a rental arbitrage business plan. It lets you predict how much money you can make from Airbnb rental arbitrage and decide whether it’s worth the hassle. A good ROI for an STR business is 8 to 12%. If you fall within this range or exceed it, rental arbitrage is a good idea.

The ROI formula: ROI = (Net Income / Total Investment) × 100

Total investment = everything you spend to redesign the property and keep it ready for ongoing rentals (e.g., monthly rent, design costs, cleaning fees, taxes, licensing costs, fixing property damage, insurance, etc.)

Net Income = everything you earn (Total income – Total expenses)

We have a detailed guide on how to make short-term rentals profitable with more tips and examples.

Alternatives to Airbnb arbitrage

If arbitrage seems too risky or challenging for your situation, several alternative approaches can provide entry into short-term rental income without the commitment of paying monthly rent regardless of occupancy.

Co-hosting arrangements: Partner with existing Airbnb hosts to manage their properties in exchange for a percentage of revenue. This reduces financial risk since you don’t pay rent directly. You handle operations while the property owner maintains ownership and the primary listing relationship.

Property management services: Offer management services to property owners who want STR income but lack time or expertise to manage operations themselves. Many property owners want the rental income but don’t want to handle guest communications, cleaning coordination, and maintenance issues that come with active management.

Revenue-sharing partnerships: Work with property owners on profit-sharing agreements where you handle operations while they provide the property. This creates a different risk and reward structure than full arbitrage, where you work with the homeowner rather than independently.

Mid-term rental focus: Consider focusing on stays of 30+ days, which often face fewer regulations and may require less intensive management than nightly rentals. These rentals typically attract traveling corporate workers, medical professionals, students, and digital nomads — often more stable guest types than vacation travelers.

Lease-to-own arrangements: Some landlords may consider lease-to-own agreements that allow you to build equity while operating short-term rentals. These rent-to-own arrangements let you lease a property with the option to buy it later.

Each alternative offers different risk-reward profiles compared to traditional arbitrage, where you’re responsible for monthly rent payments regardless of booking performance.

3 Tips on how to maximize your earnings from Airbnb arbitrage

Hosts who have a decent income from Airbnb rental arbitrage follow some common best practices. We have gathered the main ones below to help you make your STR business more cost-effective.

1. Implement the guest screening process

A reliable guest screening process can protect you from fraud, a worsening problem across booking platforms. You can automate this process with modern tools like Truvi. The platform runs Guest Screening, Guest Verification, and Sex Offender Checks (for US guests), detecting suspicious applicants so you can decline their booking early on.

Checks like these ensure only trustworthy people enter your place, minimizing the risk of financial losses from fraud.

2. Consider outsourcing property management

If you have never dealt with short-term rentals and lack experience managing guest communications, cleaning, and other routines, consider hiring someone. There are dedicated vendors that offer property management services. Factor these expenses into your budget and recalculate your short-term rental’s profitability before deciding whether hiring someone is feasible.

3. Get reliable STR damage protection

Property damage is a major risk in arbitrage since you’re responsible to your landlord for repairs and replacements. Traditional insurance wasn’t designed for short-term rentals and can take months to pay claims. You need specialized damage protection that covers guest-caused incidents and pays out quickly.

Modern Damage Protection Services like Truvi cover accidental and intentional damage, unauthorized parties, and excessive cleaning costs. When incidents occur, you get paid within days rather than waiting months for traditional insurance claims, keeping your arbitrage business operational and your landlord relationship intact.

Making arbitrage work in today’s market

Airbnb arbitrage remains a viable business model, but success requires careful planning, professional operations, and strong risk management. The markets and methods that worked during the pandemic boom may not work today, making research and preparation more important than ever.

Success depends on finding the right balance between tourism demand and rental costs, then operating with the same professionalism as established hospitality businesses. This includes screening guests carefully, maintaining properties properly, and protecting against the financial risks that come with hosting unknown guests.

With proper market selection, landlord relationships, and operational systems, arbitrage can generate solid returns. However, casual approaches or insufficient preparation often lead to disappointing results.

Ready to protect your arbitrage business from the start?

Screen guests before they book and get comprehensive damage protection that works across all platforms. Truvi’s Guest Screening and Damage Protection help you identify reliable guests and protect against property damage.

Check out pricing and get started today.