Why Truvi Damage Protection?

Guest damage is inevitable when you’re hosting regularly. A single incident can wipe out months of profit, and traditional security deposits create friction that costs you bookings.

Our Damage Protection works seamlessly with Guest Screening to eliminate financial risk without slowing down bookings:

- No guest deposits or waivers required — remove booking barriers while staying protected

- Coverage up to $1M depending on your tier, from everyday spills to major incidents

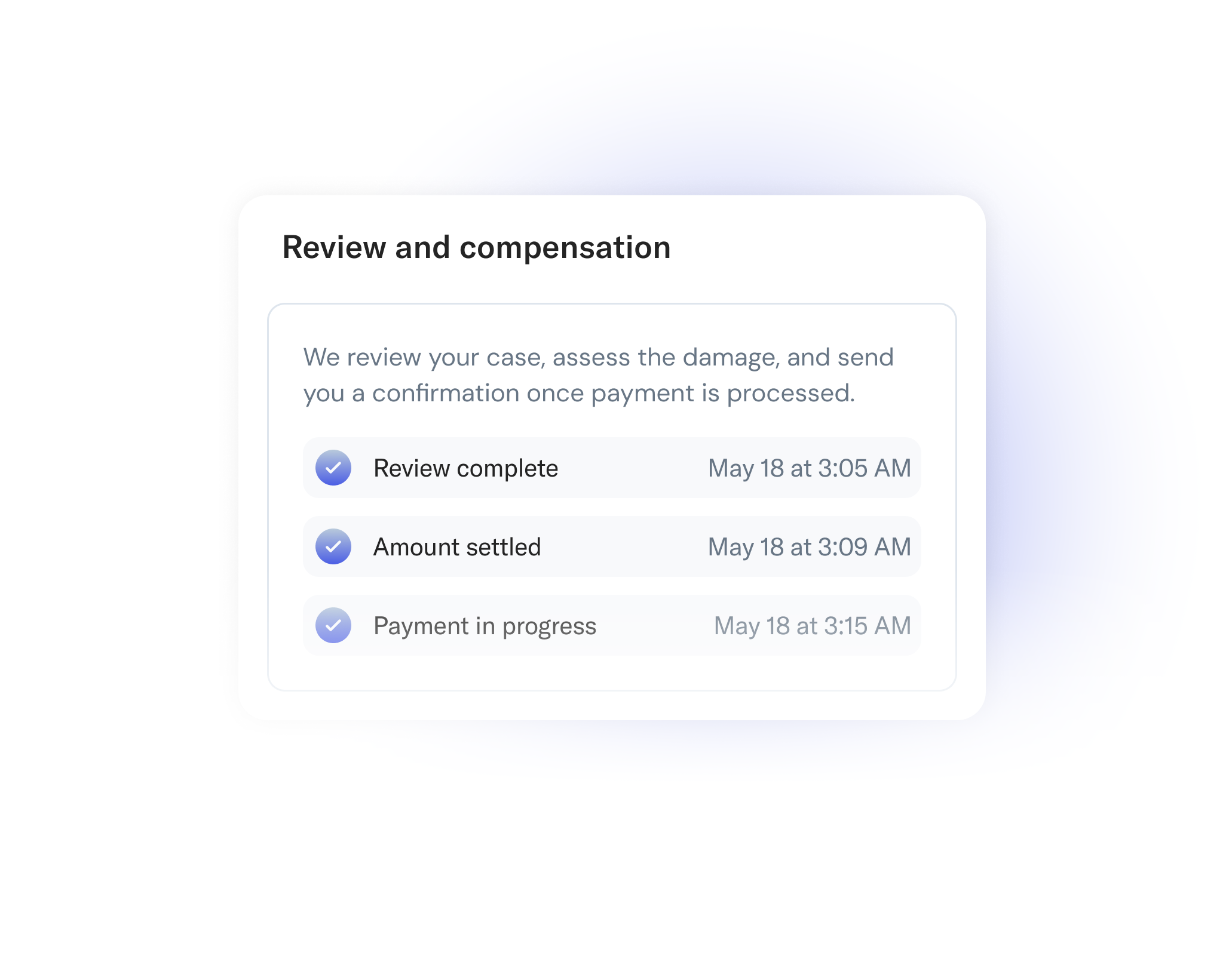

- Direct payment to you within 3-5 business days of settlement approval

- We handle guest recovery — no awkward conversations or chasing guests for money

Rejected bookings and cancellations are not charged for protection. Incidents must be reported within 14 days of checkout.

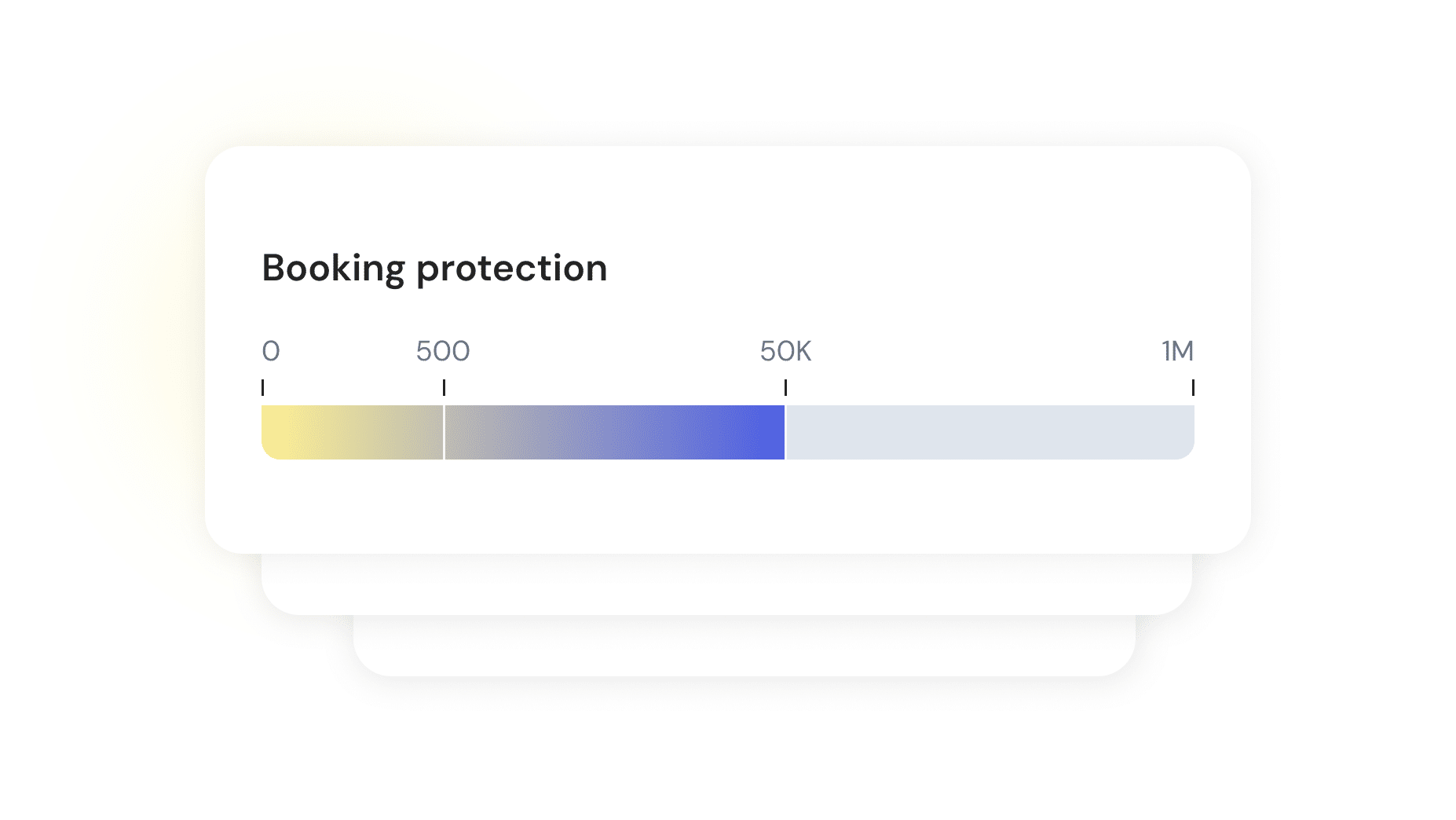

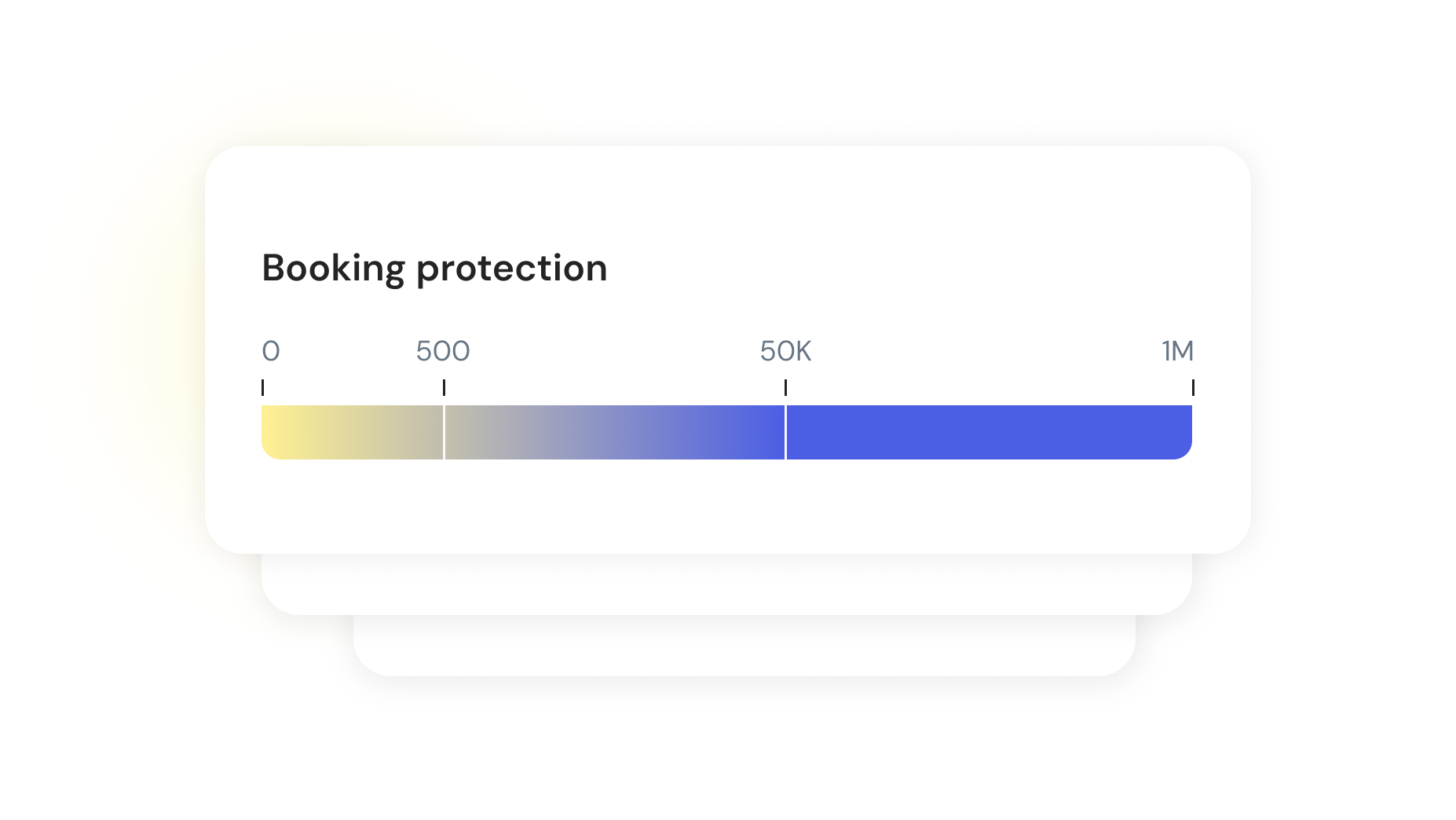

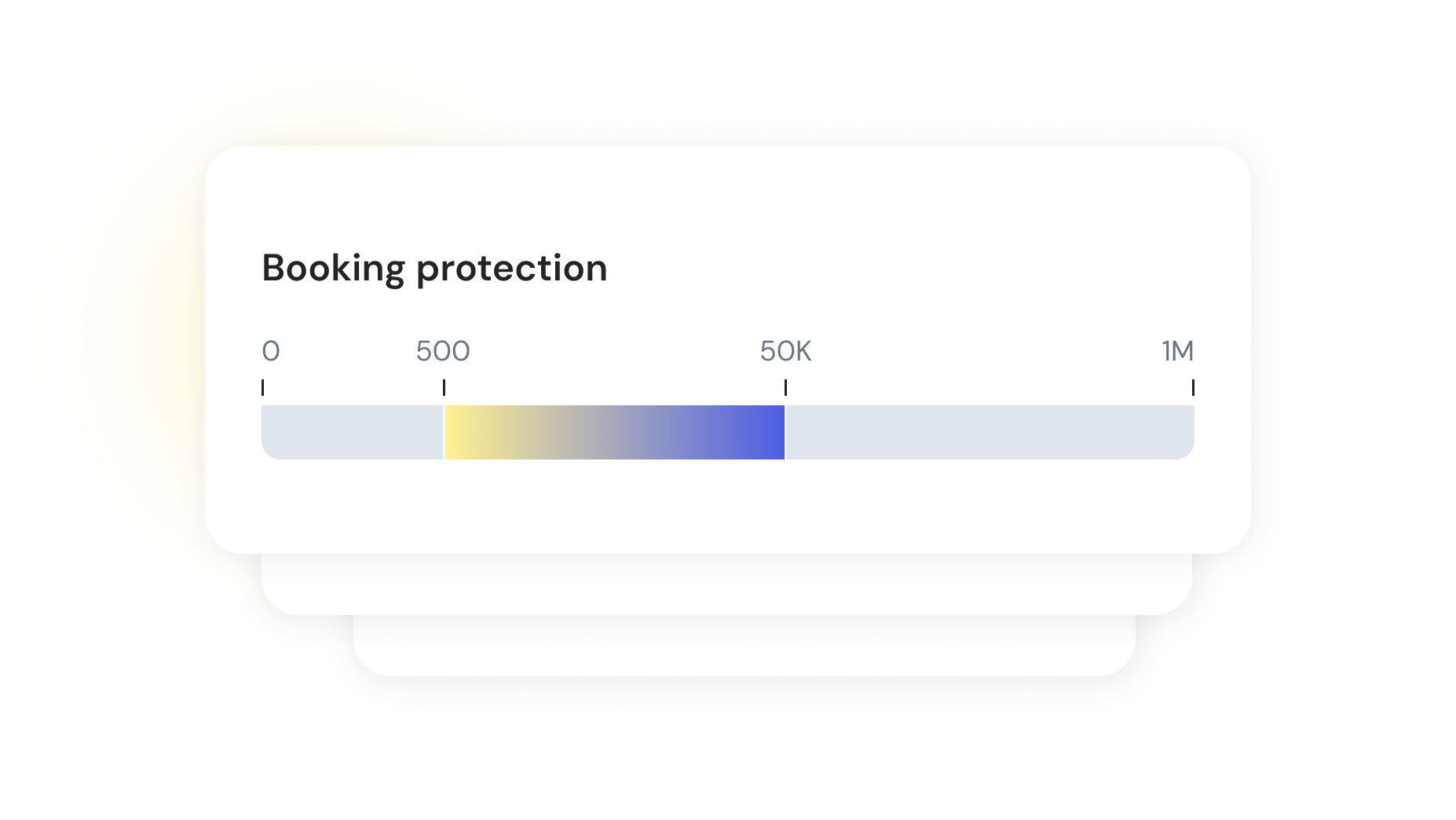

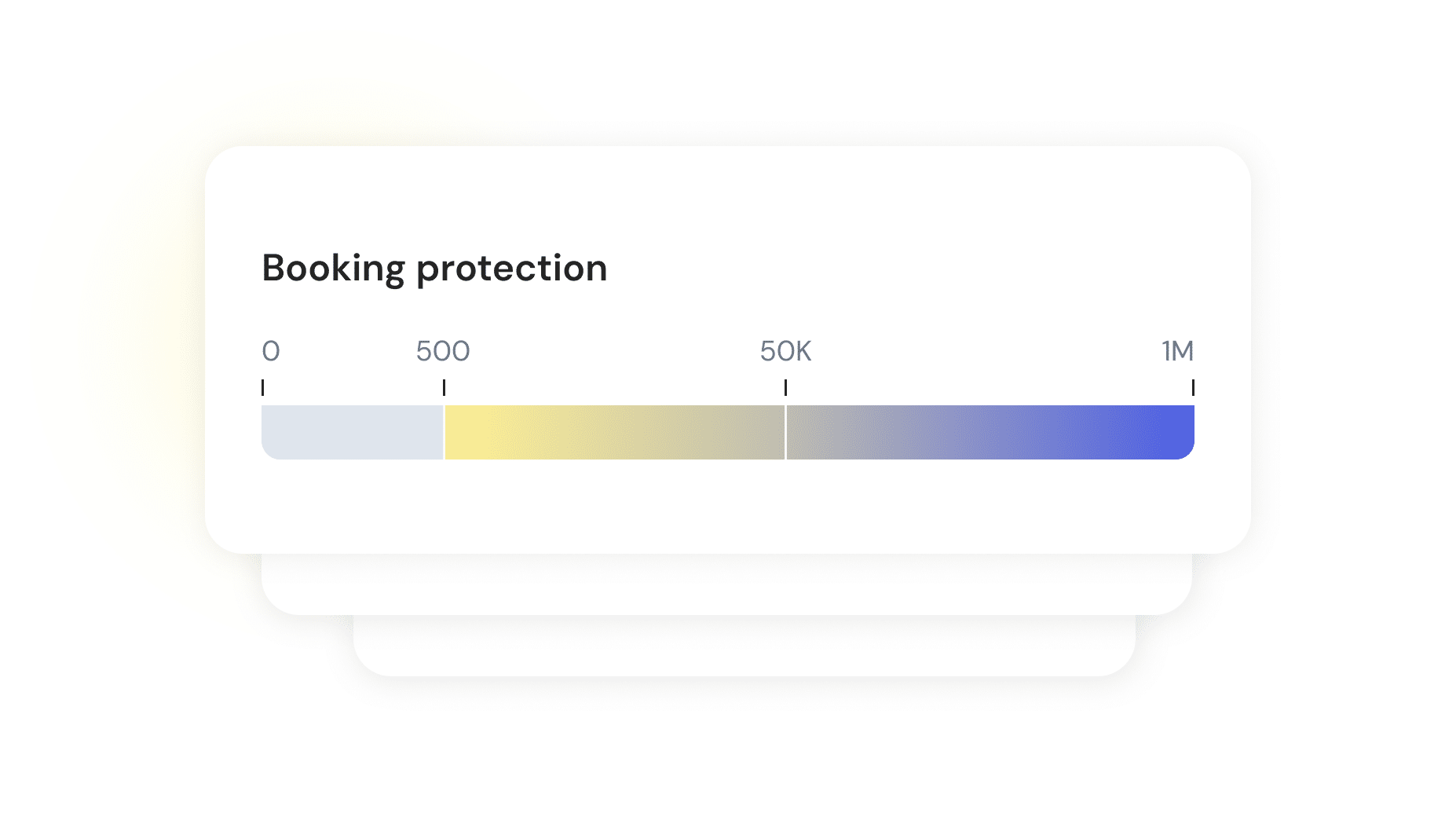

Scalable protection: from starter hosts to luxury portfolios

No deposits, no waivers, no guest friction. We handle claims, you get paid fast.

Protection from 0-500

For hosts managing frequent small damages on a budget.

Protection from 0-50K

Complete protection from everyday spills to serious incidents.

Protection from 0-1M

Full protection for high-value properties and large portfolios.

Protection from 500-50K

For hosts with deposits or waivers who want protection from major damage incidents.

Protection from 500-1M

For property management companies that need protection against major damage incidents.

What’s protected?

✓ INCLUDED

- Accidental or intentional guest damage

- Damage to rental contents

- Smoke damage in non-smoking properties

- Unauthorized parties

- Damage caused by service animals

- Excessive cleaning costs

- Replacement of broken or ruined home accessories

- New towels and linens to replace excessively soiled ones

X NOT INCLUDED

- Loss of income

- Any pet damage, excluding service animals

- Authorized parties

- General wear & tear

- Acts of nature

- Cosmetic damage not affecting functionality

- Credit card chargebacks

- Routine maintenance issues not

caused by guests - Liability claims

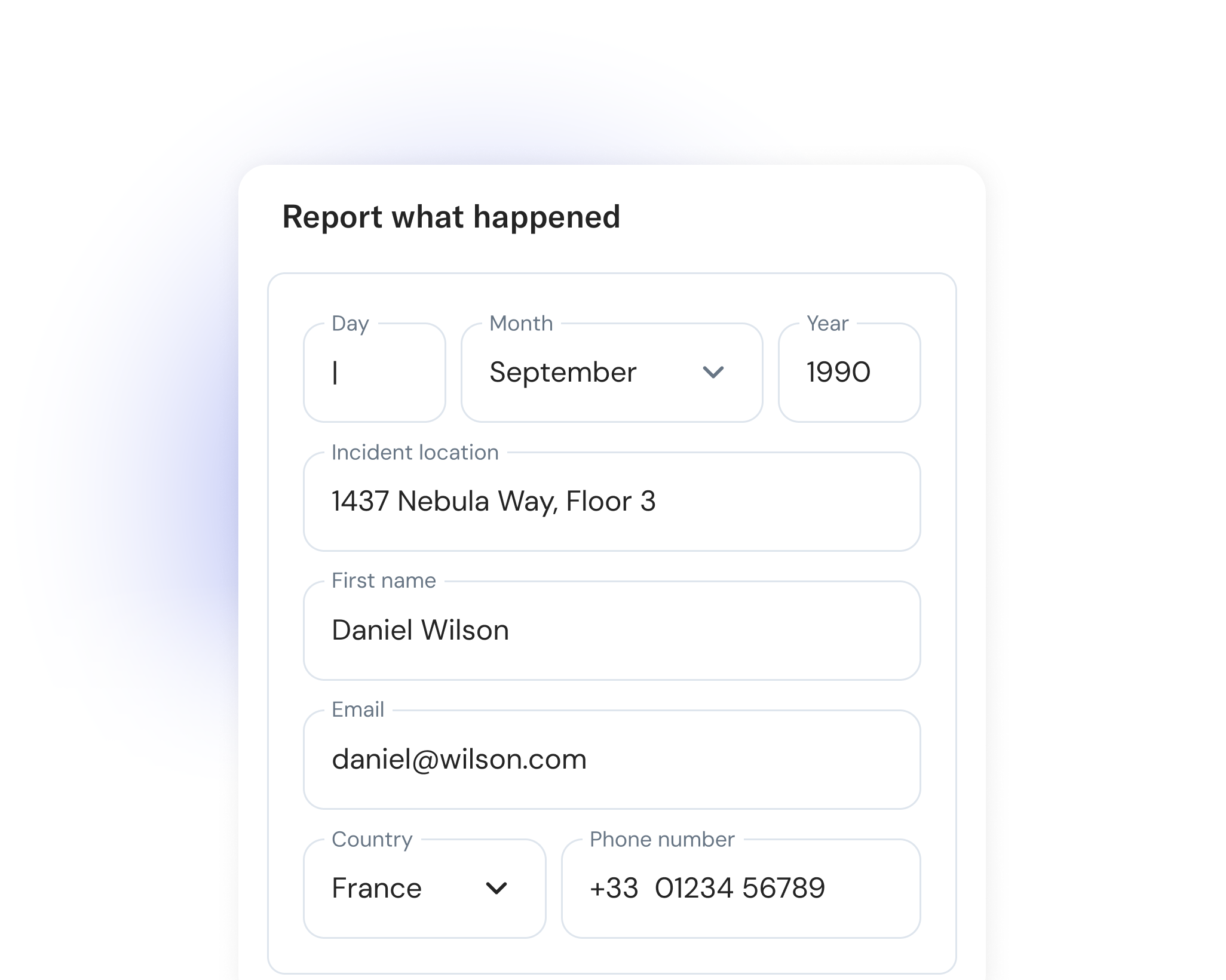

How damage claims work

Report damage, get paid fast. Our dedicated resolutions team handles everything else.

Step 1

Report damage through your dashboard

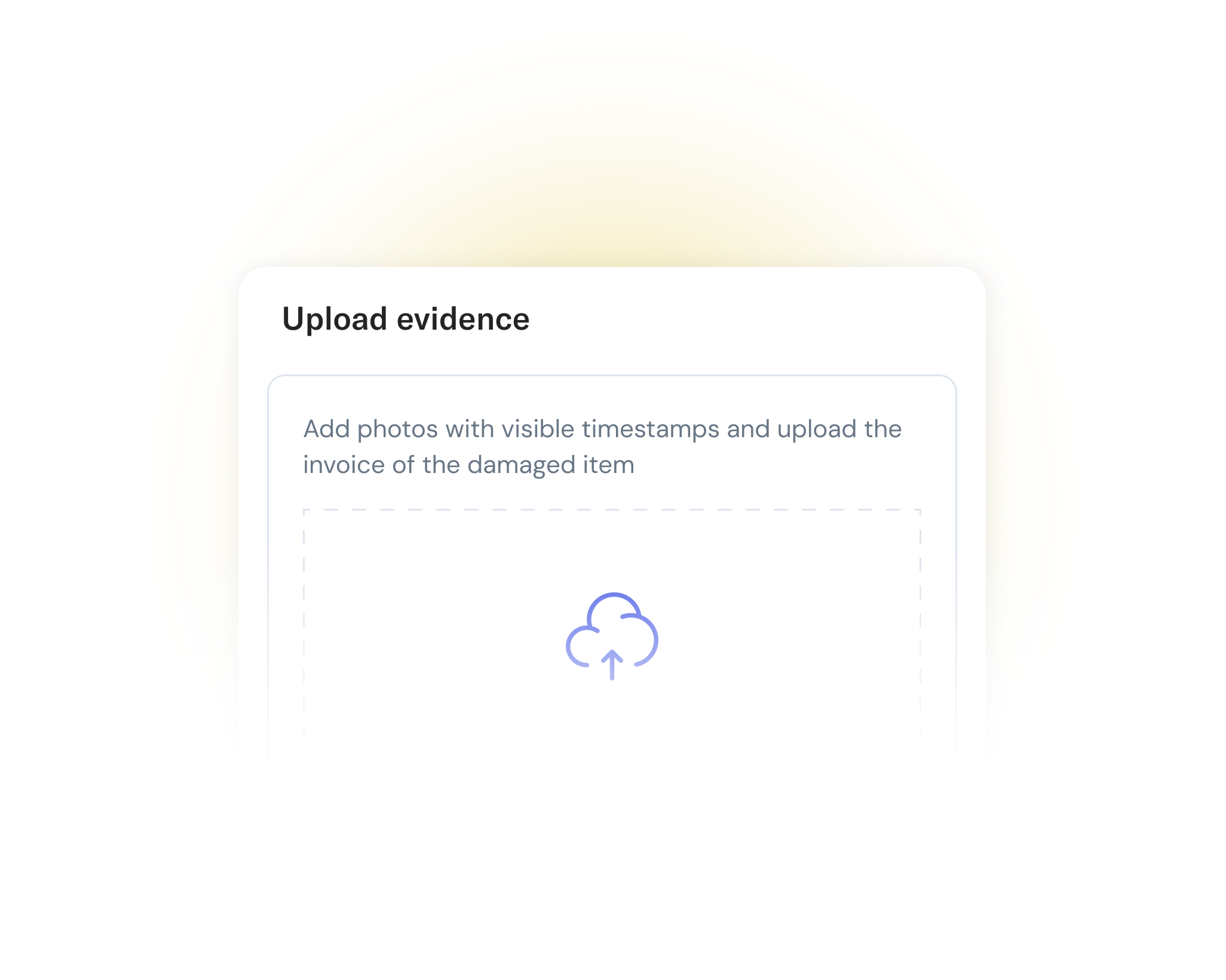

Step 2

Upload photos and repair/replacement invoice

Step 3

We review and pay you directly

Why property managers choose Damage Protection

Read about real experiences from property managers using Truvi.

“With Truvi, we could add a safety net designed specifically for the homeowners… it gives peace of mind.”