It’s every property manager’s worst nightmare: guests trash your property, leaving you with a huge bill to repair the damage.

This is exactly what happened to John Hildebrand of Hilde Homes* whose story we will share in this blog post along with other stories. After a mostly uneventful experience with guests at his Arizona vacation rental, he opened the door to find overflowing bins, a dog mess, missing appliances, and badly stained bedsheets.

Luckily, he didn’t need to wait for Airbnb to fix the situation. Thanks to Truvi’s coverage, he could reclaim his money back in 3 days.

So, what is covered by Airbnb damage policy, and how can you increase security for your Airbnb listings?

This article explains what Airbnb’s Aircover includes and covers ways to protect your Airbnb against damages. Read on to find answers to the most common questions about Airbnb guest damage policy.

Airbnb damage policy: How does it work?

When you list on Airbnb, you’ll be automatically covered by the OTA’s Aircover insurance for Hosts. This cover is free of charge, available for all hosts, and you don’t need to sign up for it separately.

Aircover Airbnb damage insurance includes:

- Up to $3 million damage protection, with special cover for art and valuables, auto and boat, damage caused by pets, loss of income, and deep cleaning.

- $1 million liability insurance to cover guest injury, damage, or theft of guest property.

- 24-hour safety line to provide support to hosts and guests.

Learn more about what Aircover does and doesn’t cover below, or read the Airbnb damage protection terms for more detailed information.

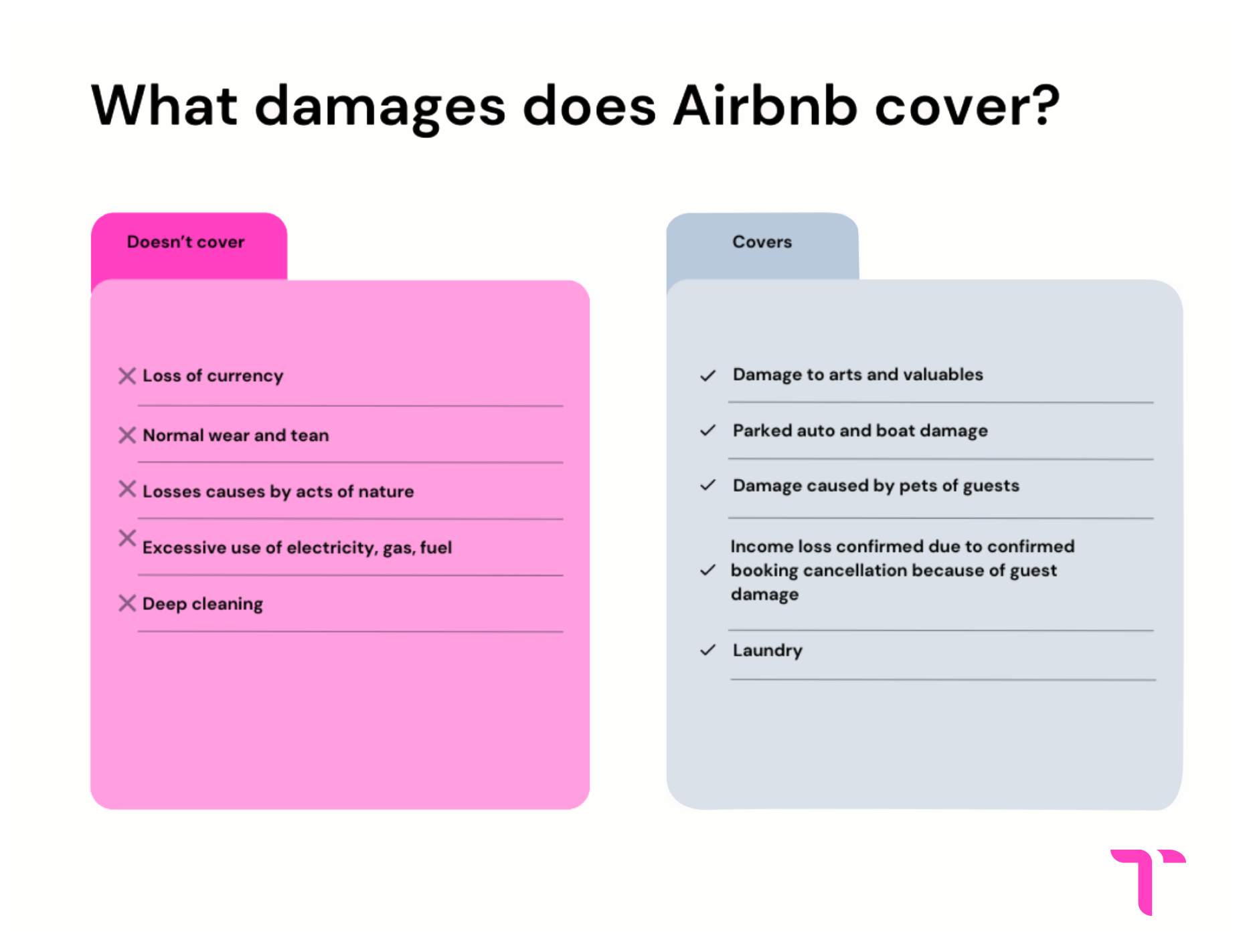

List of damages covered by Airbnb

Doesn’t cover:

- Loss of currency

- Normal wear and tear

- Losses caused by acts of nature (e.g, hurricanes)

- Excessive use of electricity, gas, fuel, water or other utilities

- Deep cleaning costs

Covers:

- Damage to art & valuables

- Parked auto & boat damage

- Damage caused by pets of guests

- Income loss due to confirmed booking cancellation because of guest damage

Overall, the Airbnb property damage policy covers losses that directly result from the actions of a guest or their visitors. If an Airbnb accidental damage has nothing to do with the guest, you are not eligible for reimbursement.

Airbnb isn’t the only place where you can list your vacation rental. Here are 15 Airbnb alternatives, dig in!

What happens if your guest damages your Airbnb?

When damage happens, you need to act fast and document everything. Here’s a real example of what property managers face and how to handle it.

Arizona property manager John Hildebrand discovered severe damage after what seemed like a normal booking. When his housekeeping team entered the property, they found guests had sneaked dogs in without paying the pet fee. There was dog mess everywhere, overflowing trash cans, badly stained towels and bedsheets, and missing appliances like hairdryers.

“There was dirt everywhere. Every single pair of sheets was destroyed, all the towels were damaged — it was very disrespectful.”

Airbnb isn’t the quickest way to get Airbnb damage covered. First, you have to document the before and after to prove that the damage happened during the stay. Then, you have to keep in mind the strict time frames. Airbnb takes a week to a month to process your Airbnb damage claim so make sure you’re not out of cash.

If you ever find yourself in a similar situation with Airbnb damage, here’s what to do:

- Document the Airbnb damages by taking photos and videos. Get testimonials from cleaning staff if they were first to enter the property.

- Communicate with guests directly through Airbnb to see if they are willing to pay for damages caused.

- If this fails and guests refuse to pay Airbnb damages, submit a claim through Airbnb’s Resolution Center. Select “Request compensation for damages” and fill out all the details.

- You have 14 days to report an incident to Airbnb, and the sooner you report, the more chance you have of being able to claim damages.

After you’ve submitted the request, guests will have 3 days to pay. If you don’t receive the money, you’ll need to contact Airbnb support. You must do this within 30 days of the damage according to the Airbnb damage policy.

John decided to report the incident to Airbnb immediately to give himself the best chance of winning a claim, and help prevent the same thing happening to other hosts.

John and many other hosts and property managers face a myriad of guest damages. Here’s a list of the most frequently occurring guest damages in vacation rentals according to Truvi’s Senior Resolution Advisor Tanya Simmonds. And look how our vacation rental dispute resolution team processes incidents.

How do you make a claim for an Airbnb damage deposit?

If you have charged a security deposit when renting a property, you are more likely to get Airbnb guest accidental damage reimbursed. Note that there are two types of damage deposits – Airbnb-required and host-required:

- Airbnb-required security deposits: The platform puts an authorization hold on a guest’s payment method and informs the guest they may be charged additionally if they cause Airbnb accidental damage.

- Host-required security deposits: Hosts use the Airbnb offline fees feature to set a security deposit. Guests can see the specific sum and conditions during the booking process.

The damage claim process is identical for Airbnb-required and host-required security deposits and allows you to get extra expenses covered. How long does an Airbnb host have to file a claim? The Airbnb damage policy gives you 14 days from the checkout date.

Follow these steps to claim the Airbnb insurance for damage:

- Log in to your Airbnb account.

- Go to the Resolution Center and file a reimbursement request.

- Select the booking.

- Go to ‘Select a reason’ and click ‘Request compensation for damages.

- Click ‘Continue’ to indicate the details of the damages.

Airbnb host damage protection requests are pretty common these days, with many properties using them:

“As an Airbnb host, charging guests for damages and cleaning fees is a common practice, but it’s important to adhere to Airbnb’s guidelines. You can set a security deposit to cover potential damages, and this amount is pre-authorized but not immediately charged to the guest. If there are damages, you need to document them and report them through Airbnb’s resolution center within 14 days of checkout (Emine Özdemir).”

How do you handle Airbnb guest damages if you don’t have a security deposit?

Although making a security deposit is a more reliable way to protect yourself, you can still get your money back even if you haven’t made a deposit.

The best strategy is to contact the guest directly. You can do this through the Resolution Center by placing a claim. Quite often, guests agree with the accusations and send the requested amount. Once Airbnb processes it, you get the money to your account.

But how to charge an Airbnb guest for damage if they refuse to pay and there is no security deposit? Then, you must involve Airbnb and ask for reimbursement under AirCover for Hosts.

What if an Airbnb guest refuses to pay for damages?

After you file a request following the rules of the Airbnb damage policy, the guest will have 24 hours to respond. If they ignore the request, decline the payment, or pay only partially, you can file a reimbursement request under Host Damage Protection, a part of AirCover for Hosts.

Airbnb Support will review the request to decide whether you are eligible for the Host Guarantee. If you are, it usually takes around two weeks to get the payment.

Still, you may not receive the requested amount if Airbnb Support considers your documentation incomplete or suspicious. Deposits are a more reliable money-back guarantee for Airbnb guest damaged property than Airbnb damage policy.

Steve Aspesi, a former Super host, shares his experience on Quora:

“If the security deposit doesn’t not cover the damage or there is a disagreement as to who’s at fault or the dollar amount, Airbnb will step in to help make things right.

As a former Super host, I was told by Airbnb that they would cover anything not covered by the deposit if my guests and I were not willing to come to an agreement. It’s important to take pictures and have conversations done on the Airbnb platform so there’s a record of what is taking place.”

5 ways to protect your Airbnb against damages

Besides wondering how does Airbnb pay for damages, you should take some precautions to detect troublesome guests and gather all critical details about potential visitors.

In our post on ways to prevent guest damage in vacation rentals, we spoke to Daniel Tocora, founder of AZ Getaway, who shared that they take damage prevention one step further by conducting thorough guest pre-screening to find red flags and spot bad guests beforehand.

Here are more ways to protect your property and avoid Airbnb claims.

1. Guest screening and ID verification

Guest screening is your first line of defense against problem bookings. The right tools catch fake profiles, suspicious patterns, and known troublemakers before they ever set foot in your property — saving you from damage, fraud, and headaches.

Airbnb has a built-in verification process that checks basic information like names, addresses, and government IDs. While this catches some fraudulent bookings, it has serious limitations. Platform screening is basic at best, and it only works for bookings made through that specific platform.

Professional property managers use dedicated screening tools that go much deeper. Truvi’s Guest Screening automatically screens every booking against multiple databases and an internal watchlist of known problem guests. It catches fake names, disposable emails, and burner phones — all the red flags that platform verification misses. The screening happens instantly with zero guest friction, so you get results without slowing down the booking process.

For higher-risk bookings or properties, add ID Verification on top. This uses biometric facial recognition technology to match government IDs with real-time selfies, confirming the person booking is actually who they claim to be. The system checks name, date of birth, and photo verification — catching identity fraud that basic platform checks can’t detect.

Here’s what Elizabeth Donn, Founder of The Reservation Specialists, says about Truvi’s ID Verification:

“Before using Truvi, I had to vet each booking situation myself. Now, I am sure at least that the identity of the guest booking matches the actual guest’s.”

The key advantage: automated screening works across all your booking channels — Airbnb, Vrbo, direct bookings, any platform. You get consistent protection everywhere, not just on one OTA. And because it integrates with major property management systems, results appear directly in your booking reports with no extra work required.

Beyond ID verification, comprehensive guest screening:

- Screens against Truvi’s internal watchlist of 800,000+ problem guests

- Flags suspicious booking patterns automatically

- Works with zero guest interaction required

- Integrates seamlessly with your PMS

Think of screening as insurance you use before problems happen. It’s cheaper and easier to decline a risky booking than to deal with property damage, police reports, and insurance claims after a problem guest checks in.

2. Short-term rental insurance and protection options

When you rent short-term, it’s your responsibility to protect your property — even when guests misbehave, break things, or leave damage. While platforms like Airbnb offer basic coverage (up to $3 million through AirCover), relying solely on platform protection leaves serious gaps.

You have two main approaches for protecting your properties:

Traditional insurance providers like Proper Insurance, Safely, and Pikl offer comprehensive policies designed for vacation rentals. These work like standard insurance — you pay premiums upfront and file claims after damage occurs. They’re best for hosts who want broad coverage including liability, natural disasters, and structural damage. The tradeoff is longer claims processing times (often weeks or months) and higher costs.

Damage protection services like Truvi take a different approach. Instead of just covering costs after problems happen, they prevent issues upfront through guest screening, then handle damage incidents quickly when they do occur. Truvi’s Damage Protection covers up to $1M with decisions typically within 5 business days — not weeks or months. You work across all booking channels including direct bookings, and avoid the guest friction of deposits or waivers. Guest screening is included, so y

The key difference: insurance is reactive (pay after damage), while damage protection services are proactive (screen guests to prevent problems, then resolve quickly when they happen).

For short-term rentals specifically, protection services often work better because:

- Guest turnover is frequent — you need screening for each booking

- Time matters — fast resolution keeps your calendar open

- Platform-independent coverage works for direct bookings and multiple OTAs

- Prevention matters as much as coverage

Many professional property managers use a combination: damage protection for day-to-day guest risks, plus traditional insurance for major structural issues or liability coverage beyond what protection services offer.

3. Vacation rental damage deposit

Security deposits are a traditional protection method where you collect a refundable amount upfront to cover potential damage. If guests leave the property in good condition, you return the full deposit. If there’s damage, you deduct repair costs before refunding the remainder.

Most platforms support deposits, though the process varies. Airbnb places authorization holds on guest payment methods, Vrbo lets you collect refundable deposits or have guests purchase protection, and Booking.com requires direct arrangements with guests.

Industry standards typically range from $250-$500 for standard properties, up to $2,000+ for luxury rentals. You can also calculate deposits as a percentage of booking totals (usually 10-12%).

John Hildebrand, who manages properties in Arizona, emphasizes the importance of layered protection:

“I don’t like to rely 100% on Airbnb. I always take it one step further — all of my guests have to go through Truvi… If you’re trying to build a business, you must always protect your investment on so many different levels.”

When using deposits, communicate the amount clearly in your terms and conditions, document property condition with timestamped photos before and after each stay, and return deposits quickly when there’s no damage. Understanding local regulations governing deposit amounts and refund timeframes is also essential.

Many property managers now combine deposits with screening and damage protection services for comprehensive coverage across all booking channels.

4. Vacation rental damage waiver

Deposits may not help you cover wear and tear damage that happens with almost every booking just because people live in your property. Guests will occasionally break a glass, leave a stain, or scratch a table. These expenses are not worth claiming from a deposit, but if left unattended over and over, they will start draining your budget.

How to deal with such cases? Consider selling a waiver.

Waiver is another way to handle small damage and may be more effective than deposits in many cases. It’s a non-refundable $50 charge included in the total rental price that waives the liability for any unintentional damages and may be a win-win in many cases. While guests don’t have to worry about the financial consequences of minor damages, renters can cover the cost of repairs or accumulate this money for emergencies.

Airbnb doesn’t support vacation rental damage waivers directly, but you can use them as an add-on.

Nick Taylor, Managing Director of Nox, explained how damage waivers improve their guest experience and security:

“Around 10% of our bookings cause some form of damage, of which, 90% can be covered by a damage waiver.”

By saving up the money they collect through the damage waiver, they always have a rainy day fund in case they need to pay for more damage.

5. Learn to spot troublesome guests in advance

Though you cannot always detect a villain with 100% accuracy, some common behaviors and vacation rental scams call for caution.

Here are the red flags to watch out for:

- Bad guest reviews — This is the most reliable indicator that guests may cause trouble, so check reviews. Hosting guests with no previous reviews can also be risky.

- Bending the rules — Guests who try to dispute your house rules or convince you to make an exception (for example, to allow pets if you have a policy against it) may be problematic.

- Payment difficulties — When guests don’t pay on time, their cards get declined, or they want to pay through alternative methods, this could mean trouble.

- Odd-looking email address — A strange email address with random numbers could be created for the purpose of creating a new Airbnb account, therefore might be suspicious.

- Poor grammar — If your guest has difficulty communicating or uses “text” language, this could indicate a scammer. However, this might be because your guests are communicating in a second language.

- Live locally — If your guest’s home address is nearby, this should raise your suspicions. They might be looking to rent a property to throw a party.

For John Hildebrand, whose story we’ve shared above, there were no obvious red flags. The guests asked to extend their stay a couple of times, and though there were some difficulties with processing their payment, the money eventually went through.

Because vacation rental scams are hard to spot, it’s vital to have a secure screening process such as Truvi that can catch potentially troublesome guests before the booking begins.

Truvi captures all guests’ details and runs extensive background checks against authoritative databases for fraud, criminal activity, and sex offenses.

Protect your Airbnb properties faster than the platform can

Airbnb’s damage protection exists, but it comes with serious limitations. The documentation requirements are extensive, the process takes weeks or months, and you’re left waiting while repair costs pile up. When you’re managing properties professionally, you can’t afford that kind of delay.

Property managers who protect their business most effectively use layered protection: Airbnb’s coverage as a baseline, plus dedicated tools that work faster and more reliably. Truvi’s Damage Protection covers up to $1M with decisions typically within 5 business days — not weeks or months. Combined with Guest Screening to prevent problem bookings before they happen, you’re protected on both ends.

Property managers worldwide are already using Truvi to protect their businesses. Saskia Van der Bolt, CEO at Villa in Umbria, says:

“The biggest benefit is not having to chase after damage payments. It takes away the bureaucratic hassle, saves time and it calms down hosts who worry about damage to their properties.”

It’s also helped grow her business: “The added security is a big selling point for homeowners. New hosts often worry that guests will ruin their homes. Although these fears are often unfounded, having the extra security can help to persuade homeowners to work with me.”

Ready to stop chasing guests for damage payments?

Get up to $1M in protection with 5-business-day turnaround. No months-long waits, no extensive back-and-forth with platforms.

View pricing and protect your properties today.